The model and the proposed option pricing methodStatistical Parametric Mapping refers to the construction and assessment of spatially extended statistical processes used to test hypotheses about functional imaging data (fMRI, PET, SPECT, EEG, MEG). These ideas have been instantiated in software that is called SPM.3. When price drops to around support line, buy the stock 4. Matlab 2012 Price Software That IsWhen price drops below support line, short the stock and consider the support line as the new resistance line Following are sample plots of support/resistance line and the plot of its trading performance Figure 2: Recognizing Support Line and Resistance Line in MatlabThis study focuses on the modelling of oil price behaviour during the period 2012-2017 using the Geometric Brownian Motion (GBM) and Mean-Reversion Jump.Are useful for empirical analysis of asset returns and managing the corporate credit risks.

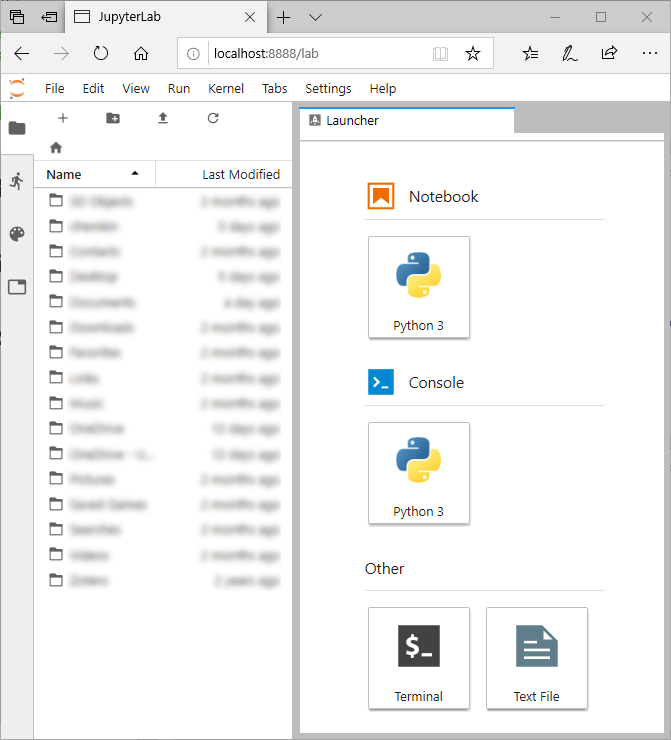

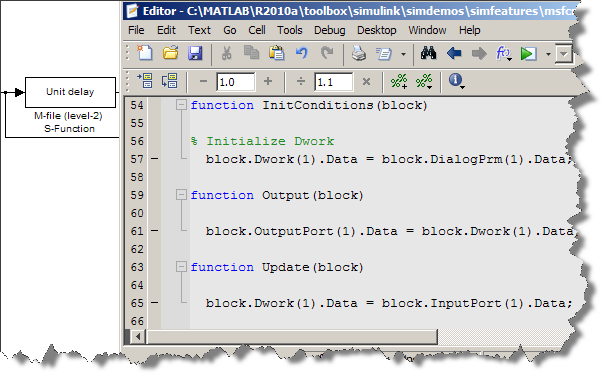

#Matlab 2012 price how to

Hello Everyone,I have a house price data with two rows, 1st: Date (monthly) and 2nd: Price of house, my data has the price record of houses from 1990-2012, I would like to predict the price of house in 2013 by calculating the moving average of the prices i have to forecast and predict the 2013 house price.Please any idea on how to carry out simple time series analysis (step-by-step)in MATLAB. We consider European options pricing with double jumps and stochastic volatility. We derived closed-form solutions for European call options in a double exponential jump-diffusion model with stochastic volatility (SVDEJD). We developed fast and accurate numerical solutions by using fast Fourier transform (FFT) technique.

0 kommentar(er)

0 kommentar(er)